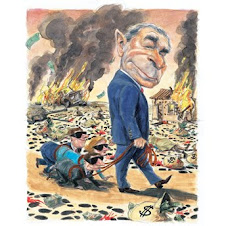

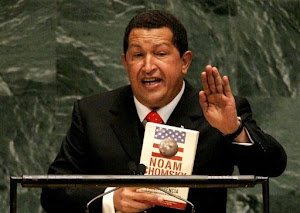

Bisogna capire bene da che cosa è fatta l'insurrezione contro Gheddafi in Libia, quanto c'è di sofferenza popolare e giovanile e quanto di interessi tribali che si sono aggrovigliati con quelli USA e delle multinazionali dell'Energia.

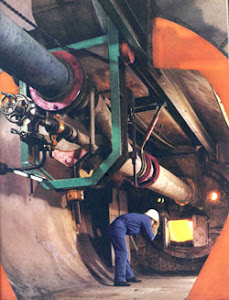

Quello che è certo è che il metanodotto che porta il gas dall'Algeria alla Libia alla Sicilia è fermo. Non escludo che una vittima designata di questa rivolta sia l'Eni e comunque la politica commerciale autonoma dell'Italia che gli USA hanno "subito" con molti mal di pancia. Il PD maramaldesco farebbe bene a stare più accorto nelle critiche ed a distinguere l'Italia da Berlusconi e la Libia da Gheddafi

La grandiosa opera di pace del metanodotto, estranea agli interessi delle Sette Sorelle, garantisce energie e benessere da trenta anni all'Italia, all'Algeria, alla Libia. Gli Usa sono stati ostili da sempre.

La politica fatta dal governo italiano nei confronti della Libia e della Russia è la meno berlusconiana fatta dal Governo Berlusconi. Viene da molto lontano, dalla illuminata apertura terzamondista e pacifista di La Pira e Moro, di Nenni e di Fanfani.

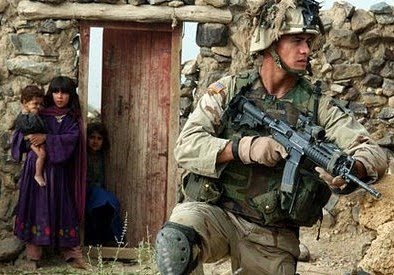

Gli obiettivi dei rivoluzionari in Libia non sono chiari, non sono stati espressi. L'anelito di libertà e di democrazia si esprime in modi diversi.

Non difendo il regime di Gheddafi ma vorrei capire chi lo sta demolendo.

L'Italia rischia di essere travolta non solo da una ondata emigratoria ma dal crollo di suoi fondamentali interessi economici

crollo che va a sommarsi alla crisi ed al trasferimento della Fiat in USA ed alla scomparsa della sua industria di base e manifatturiera.

Anche la pace potrebbe essere travolta da una crisi di tutta l'area del Mediterraneo dentro la quale mimetizzare l'attacco e l'incenerimento dell'Iran e la fine della Palestina.

Pietro Ancona

Features

Libya's revolt scares oil traders

"Nothing explodes like an oil refinery and rioters tend to like to burn things," analyst says.

Chris Arsenault Last Modified: 22 Feb 2011 03:06 GMT

Email ArticlePrint ArticleShare ArticleSend Feedback

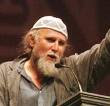

Italy has the most to lose from a revolution in Libya, because of its business ties with Muammar Gaddafi's government, according to one energy analyst [GALLO/GETTY]

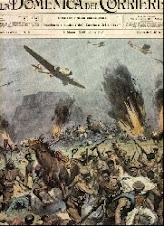

As military jets pound protesters in the Libyan capital, oil analysts around the world are watching apprehensively from comfortable offices.

"The price for crude oil is up by five dollars per barrel, and most of the press is relating this rise to the tensions that are escalating as we speak," said Stephen Jones, the vice president of market services with Purvin & Gertz, an energy consultancy based in Houston, Texas.

“Unrest in the greater Middle East market-place is becoming a greater concern to global oil markets," Jones told Al Jazeera in a phone interview.

The price of Brent crude hit $105 per barrel on Monday, and pushed as high as $108 in after-hours trading, levels not seen since September 2008.

Libya, Africa's third largest oil producer, pumps out around 1.6 million barrels of oil per day, meeting roughly two per cent of global demand.

Fuelling revolt

Wealth from light sweet crude has allowed Muammar Gaddafi, an autocrat described as a "mercurial and eccentric figure who suffers from severe phobias” by US diplomats in WikiLeaks documents, to hold power for more than 40 years.

While oil production has only dropped by 50,000 barrels per day, according to International Energy Agency reports, Gaddafi's luck seems to be running dry.

"When you are using military force against protests in your capital, it shows how far it has gone," said Peter Zeihan, vice president of analysis with Stratfor, a global intelligence company.

At least 61 people died in unrest on Monday, adding to several hundred who have been killed in recent protests. Two Libyan air force jets landed on the island of Malta on Monday night; their pilots claimed they defected after refusing to bomb anti-government protesters. Several Libyan diplomats have also defected, protesting attacks on demonstrators.

"Libya is a genuine revolution. The military is split," Zeihan told Al Jazeera in a phone interview. A recent uprising in Egypt did not qualify as a revolution, he said, because the military remained united and firmly in control.

Libyans may be excited about the prospects of change. But energy markets beg to differ. "In general, oil markets prefer stability and stability often comes with [various] modes of governance," said Jones, hinting that markets are not perturbed by dictatorships, so long as the pipelines keep gushing.

"The best case scenario, from the oil market’s stand point, would be for unrest to calm," Jones added. "That might be at odds with the populace." The analyst would not comment on what would happen to energy markets if unrest spread to Saudi Arabia, the world’s biggest oil producer.

Paul Horsnell, head of oil research at Barclays Capital, told the UK Telegraph newspaper that Libya's uprising is "potentially worse for oil than the Iran crisis in 1979".

For global energy markets, that assessment might be an exaggeration. Libya's main oil infrastructure is located in the desert, far from population centres facing violence, said Stratfor's Zeihan. While drilling platforms and other expensive extraction equipment seem safe, refineries and loading platforms could be damaged.

"Nothing explodes like an oil refinery and rioters tend to like to burn things," Zeihan said. “The country is self-sufficient in its refined goods, if its refineries remain intact.”

An Italian job

While Libya produces enough petroleum for domestic consumption, its former colonial master Italy is not so fortunate.

"The Italians have the most to lose," Zeihan said. "They get about one third of their oil and 10-15 per cent of their natural gas from Libya."

Eni, Italy’s biggest oil company which is partially owned by the government, has pledged to invest up to $25bn in Libya. Eni’s share price fell 5.1 per cent on Monday, the biggest drop since July 2009.

"If I was Eni, I would be terrified right now," Zeihan said. "The Italians don’t have an energy policy; they have even less of an energy policy than the Americans."

Italy is Libya's biggest trading partner. About $17bn worth of goods and services were exchanged between the two countries in 2009.

The Libyan Investment Authority, a sovereign wealth fund which invests Libya’s oil money overseas, owns about two per cent of Finmeccanica SpA, Italy’s biggest defense company.

If Gaddafi’s regime falls, it is unclear how a new government would approach relations with Italy, while it is unlikely any government would stop oil exports to Europe, Zeihan said.

"Whoever takes power, has an interest in producing oil and natural gas,” he said. If I was the Europeans, I would put together a nice little aid package, to see that the contracts move regardless of who comes to power. It is an opportunity for everyone who isn’t Italy."

International energy companies, including Eni, Shell, BP and Norway’s Statoil have repatriated some personnel from Libya, according to reports.

While analysts say that it is unlikely any new government would nationalise the energy industry, the behavior of specific tribes in Libya is harder to predict.

On Monday, the head of the Al Suwayya tribe in eastern Libya threatened to cut oil exports to western countries within 24 hours unless the authorities put an end to the "oppression of protesters".

While Libya doesn’t produce as much oil as other countries in the region “it is still a major producer," said the Texas-based analyst Stephen Jones. "The question is: How much of their production could be put at risk?"

Source: Al Jazeera and agencies

Iscriviti a:

Commenti sul post (Atom)

.jpg)

.jpg)

.jpg)

1 commento:

Credo he l'Italia stia giocando una

partita su due tavoli. Il ruolo

dell'ex Sismi sarà accertato dopo.

Forse per l'intera questione

hanno ragione (fin dall'inizio)i

radicali.

Non a caso hanno Dalema al

controllo....

Comunque il sito dove ho letto

il suo articolo è bloccato....

Altro mistero italiano...

Posta un commento